is an inheritance taxable in michigan

Its applied to an estate if the deceased passed on. Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today.

Estate Lawyer In Michigan 30 Years Experience

Only a handful of states still impose inheritance taxes.

. An inheritance tax is a levy. Michigan Taxes on Annuities. The inheritance tax is only levied by the state where it is relevant.

Although Michigan does not impose a separate inheritance or estate ta x on heirs you may have to pay state taxes on your annuity income. Michigan Inheritance Tax and Gift Tax. Mom recently passed and left an IRA with me listed as beneficiary.

Inheritance tax is levied by state law on an heirs right to receive property from an estate. The State of Michigan does not. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

In 2021 federal estate tax generally. Taxable income is all income subject to Michigan individual income tax. The estate tax is a tax on a persons assets after death.

Is the Inheritance I Received Taxable. I will be splitting it with my sisters. The Michigan inheritance tax was eliminated in 1993.

This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is. There is no federal inheritance tax but there is a federal estate tax. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Whether youll pay inheritance tax and how much. That tax is applied to a persons heirs after they have already received their inheritance. The inheritance tax is only levied by the state where it is relevant.

What is Michigan tax on an inherited IRA. MI HAD an inheritance tax for estates of decedents who passed away prior to 10193. However if the inheritance is considered income in respect of a decedent youll be subject to some taxes.

What is the inheritance tax in Michigan. View a list of items included in Michigan taxable income. Twelve states require an estate tax while the federal government imposes the estate tax on any estate worth more than a.

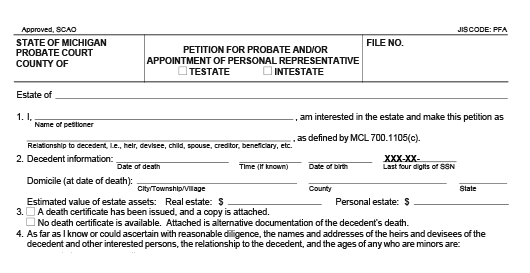

A copy of all inheritance tax orders on file with the Probate Court. There is no federal inheritance tax but there is a federal estate tax. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect.

Like the majority of states Michigan does. This list serves as a guide and is not intended to replace. Mom had opted to have.

Generally no you usually dont include your inheritance in your taxable income. Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. Michigan does not have an inheritance tax with one notable exception.

Where do I mail the information related to Michigan Inheritance Tax. Lansing MI 48922. A Federal Estate Tax return is required to be filed if the fair market value of the.

Is there a contact phone. Generally speaking your inheritance is or could be taxableHowever the full story is more complicated than a simple yes or no answer.

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

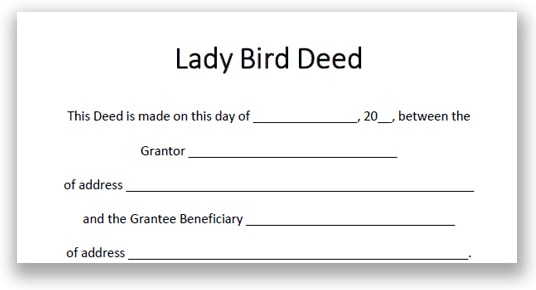

Michigan Lady Bird Deed The Major Pros And Cons Explained

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Lady Bird Deed Michigan Quit Claim Deed What To Know

Michigan Inheritance Laws What You Should Know

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Michigan Inheritance Laws What You Should Know Smartasset

Estate Planning Attorney Law Offices Of Rl Johnson Pllc

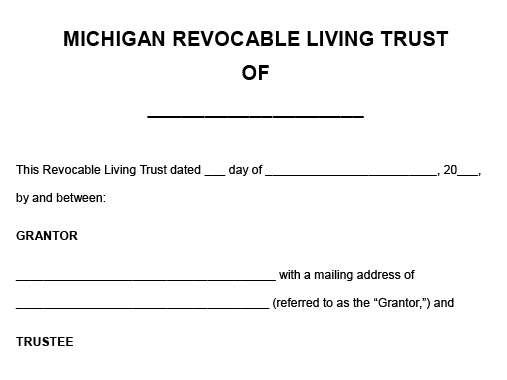

Create A Living Trust In Michigan Legalzoom

How Long Does Probate Take In Michigan Factors Impact Probate

Federal And Michigan Estate Tax Amounts On Inheritances

Michigan Health Legal And End Of Life Resources Everplans

Estate And Inheritance Taxes Urban Institute

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Tax Lawyer Business Formation Reorganization Dissolutions

The Laws Of The State Of Michigan Relating To The Descent And Distribution Of Property With Digest Of The Inheritance Tax Law Michigan Trust Company Grand Rapids Mi 9781277895308 Amazon Com Books